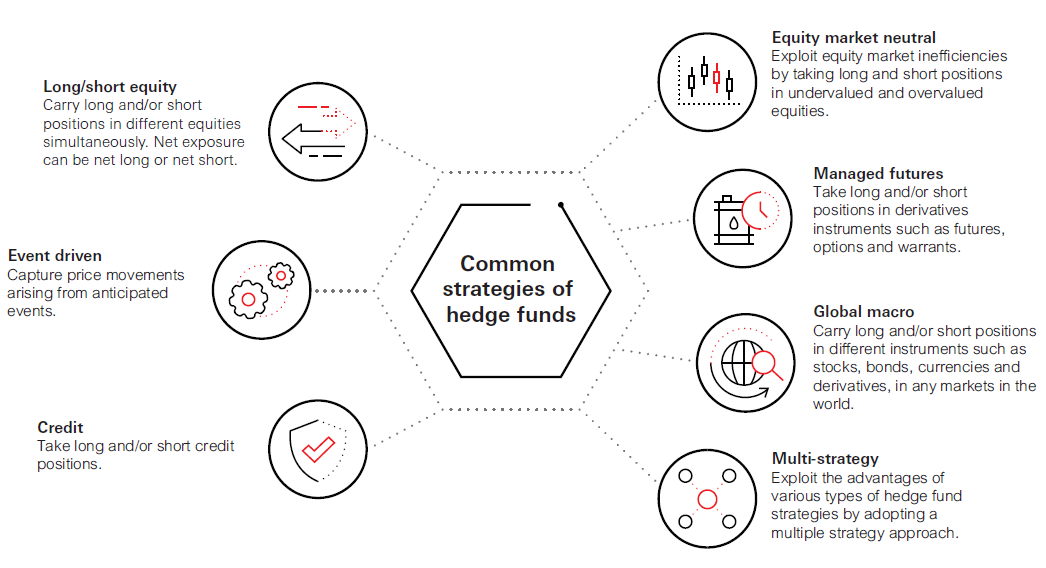

1. Long/Short Equity Funds

These funds take both long and short positions in equity securities, allowing managers to profit from both rising and falling stock prices while maintaining market neutrality.

2. Event-Driven Funds

Specializing in corporate events like mergers, acquisitions, and restructurings, these funds capitalize on price inefficiencies during major corporate transactions.

3. Global Macro Funds

These strategies focus on broad economic and political trends, investing across currencies, commodities, bonds, and equities based on macroeconomic analysis.

4. Relative Value Funds

Also known as arbitrage funds, they exploit price differences between related securities, including convertible bonds, fixed income, and equity derivatives.

5. Multi-Strategy Funds

These diversified funds combine multiple hedge fund strategies within a single portfolio, providing risk reduction through strategy diversification.

:max_bytes(150000):strip_icc()/fundmanager.asp-FINAL-1-ab3db6e95d5d437fb42e5f9a30bd5ecd.png)

:max_bytes(150000):strip_icc()/Master-feeder-fund_final-e6732fa43d4545d08c75bfe4ded586c9.png)