Explore web search results related to this domain and discover relevant information.

Welcome to Have Fund – our mission is simple, to lay a solid financial "foundation" for those who want to unravel the mysteries of the financial world and set themselves up for success. School may have skipped the "finance 101" lessons, but now is your golden opportunity to sieze the day, ...

Welcome to Have Fund – our mission is simple, to lay a solid financial "foundation" for those who want to unravel the mysteries of the financial world and set themselves up for success. School may have skipped the "finance 101" lessons, but now is your golden opportunity to sieze the day, escape the rat race, and pave the way to financial freedom!Impressive strides in boosting your financial know-how! Now, as you set your sights on broadening your horizons, whether it's building an emergency fund or preparing for the exciting journey of marriage—congratulations, by the way!—we've got the lowdown to fuel your progress.

Article traces rise and fall of hedge fund Gotham Partners under management of William A Ackman and David P Berkowitz; Gotham began in 1993 with $3 million and ballooned its assets to $568 million peak in 2000; devastating setbacks and investors' demands for cash redemptions led managers to ...

THEY had a glittering client list, dazzling reputations and smarts galore, but as 2002 drew to a close, William A. Ackman and David P. Berkowitz, hedge fund managers at Gotham Partners, were desperate. They had received a mountain of requests from investors asking for their money back and had suffered a devastating setback in one of their biggest investments.But Gotham had little in the way of liquid assets. What had begun in 1993 as a hedge fund specializing in undervalued stocks had morphed into a portfolio of private companies and thinly traded public ones, all exceedingly hard to sell. As 2003 dawned, Mr. Ackman and Mr.As last fall became winter, and their situation grew increasingly dire, they turned to a strategy that had worked for them before but that one investor surmises only compounded their problems this time: they published research on their Web site in support of their large positions in two companies, MBIA and Pre-Paid Legal Services. That decision to publicly promote two of their biggest holdings -- known in Wall Street parlance as talking one's book -- is highly unusual among secretive hedge funds, which are lightly regulated and managed for wealthy individuals.Spitzer, the force behind the nearly $1 billion settlement with top brokerage firms over stock research, has zeroed in on the murky hedge-fund world. And in a letter sent to investors on Thursday night, Gotham said it had received a letter from the Securities and Exchange Commission as part of an informal inquiry, as well as subpoenas from Mr.

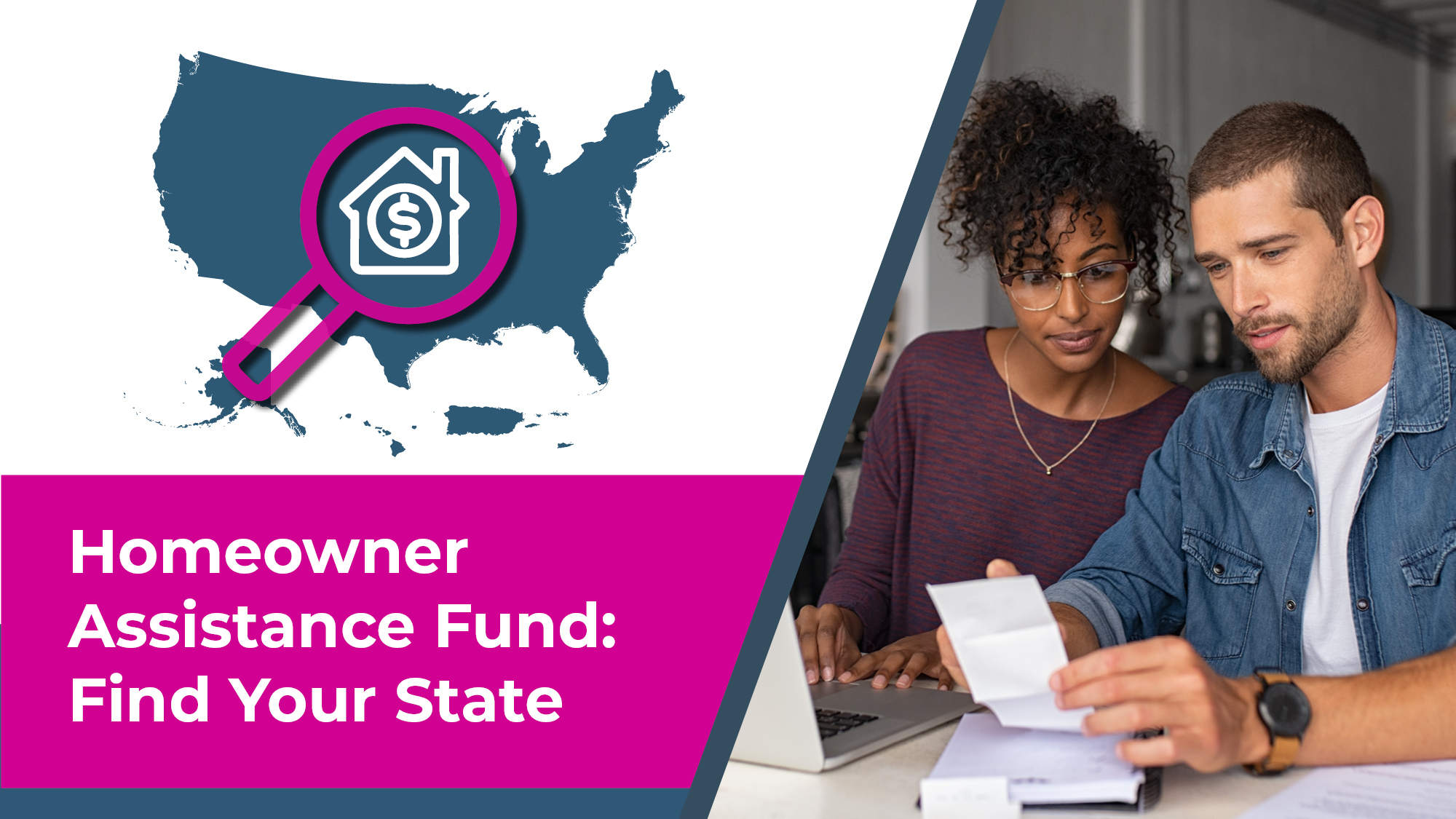

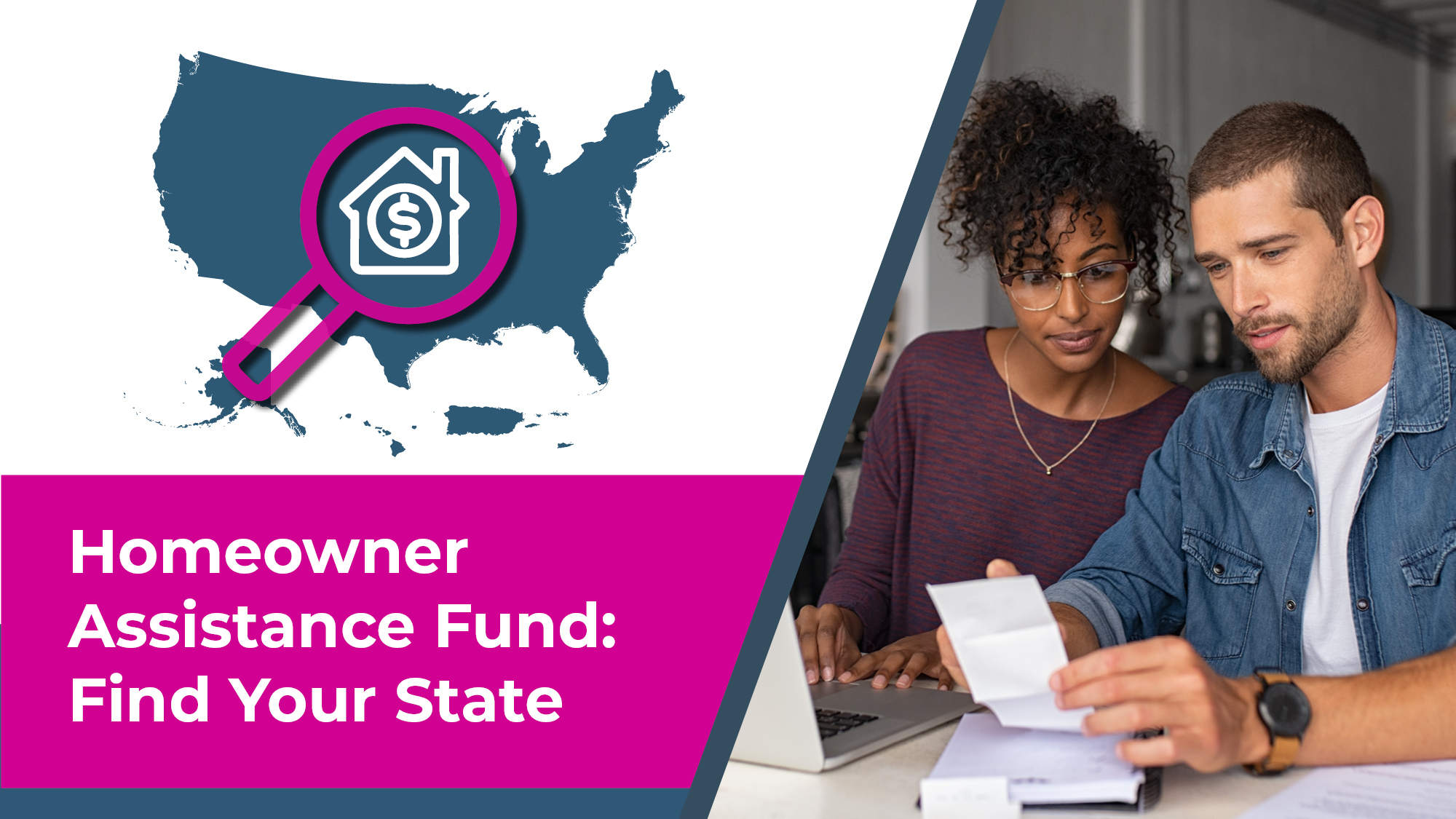

The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the impacts of COVID-19. The HAF program is overseen by the U.S.

Homeowner Assistance Fund by State Accede al recurso en español aquí. The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the impacts of COVID-19.The HAF program had delivered more than $7.5 billion in assistance to nearly 575,000 struggling homeowners through September 2024. In total, state HAF programs have expended nearly 90 percent of the $9.42 billion they received through HAF. The data shows HAF continues to assist underserved communities.Eighty-eight percent of HAF recipients had incomes at or below area median income (AMI), including 51 percent who earned 50 percent or below AMI. Further, 39 percent of HAF beneficiaries identified as Black and 19 percent as Latino. (Source: U.S.The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the impacts of COVID-19. The HAF program is overseen by the U.S.

หนึ่งในกองท...ระจายเงินลงทุนไปยัง 5 กองทุน ได้แก่ BlackRock Global Funds – World Technology ซึ่งถือเป็นกองทุนหลัก ด้วยสัดส่วน ...

หนึ่งในกองทุนที่น่าสนใจสำหรับการกระจายการลงทุนในบริษัทยักษ์ใหญ่ระดับโลกเหล่านี้คือ การลงทุนผ่านกองทุนเปิดเอ็มเอฟซี โกลบอล อัลฟ่า ฟันด์ หรือ MGA ซึ่งไม่ได้เลือกนำเงินไปลงทุนกับกองทุนใดกองทุนหนึ่งในต่างประเทศ แต่ใช้กลยุทธ์การกระจายเงินลงทุนไปยัง 5 กองทุน ได้แก่ BlackRock Global Funds – World Technology ซึ่งถือเป็นกองทุนหลัก ด้วยสัดส่วน 73.48%ส่วนอีก 4 กองทุน ได้แก่ Polar Capital Funds – Global Technology สัดส่วน 7.98% Allianz China A Shares สัดส่วน 5.42% Wellington Global Quality Growth Fund สัดส่วน 4.82% และ Edgewood L Select US Select Growth I USD สัดส่วน 3.34% ส่วนเงินลงทุนที่เหลือจะใช้ลงทุนในสัญญาซื้อขายล่วงหน้า (Derivatives) เพื่อป้องกันความเสี่ยงจากอัตราแลกเปลี่ยนเงินตราต่างประเทศ

HDFC Mid Cap Fund has grown sevenfold in a decade with stellar SIP returns and a five-star rating. Find out how it performs across cycles and if it suits you.

HDFC Mid Cap Fund has quietly become a giant. With nearly Rs 84,000 crore in net assets, it’s now by far the largest mid-cap fund in India, almost seven times bigger than it was a decade ago. And it isn’t just size.Over the past three, five and 10 years, the HDFC Mid Cap Fund has delivered annualised returns of 25.79 per cent (third-best in the category), 29.61 per cent (fifth-best) and 19 per cent (sixth-best), respectively.Even when compared with other mid-cap funds, HDFC Mid Cap has been a smoother ride. Its ups and downs (measured by standard deviation) were 13.85 per cent in the last three years, while the average mid-cap fund swung wider at 15.5 per cent. Simply put, standard deviation is just a measure of how much a fund’s returns move up and down.The fund also carries a five-star rating from Value Research.

AmeriCorps provides grants to a broad range of local and national organizations and agencies committed to using service to address compelling community issues

The HAF is for the purpose of preventing homeowner mortgage delinquencies, defaults, foreclosures, loss of utilities or home energy services, and displacements of homeowners experiencing financing hardship due to the pandemic, and assistance that promotes housing security. Funds are available until September 30, 2025.Funds will be distributed based on a formula that considers: the average number of individuals who are unemployed over a time period between 3 to 12 months; the total number of mortgagors with mortgage payments that are more than 30 days past due or mortgages in foreclosure.ARPA provides that HAF funds are to be used “to mitigate financial hardships associated with the coronavirus pandemic by providing such funds…to eligible entities for the purpose of preventing homeowner mortgage delinquencies, defaults, foreclosures, loss of utilities or home energy services, and displacements of homeowners experiencing financial hardship after January 21, 2020.In addition to the list of “qualified expenses” ARPA provides funds can also be used for “(G) any other assistance to promote housing stability for homeowners, including preventing mortgage delinquency, default, foreclosure, post-foreclosure eviction of a homeowner, or the loss of utility or home energy services, as determined by the Secretary.”

A hedge fund is similar to a mutual fund. It pools money from multiple investors and invests it in securities like stocks and other assets. Unlike mutual funds, though, hedge funds use more aggressive and riskier strategies. They are also very exclusive, which means they are generally only ...

A hedge fund is a pool of money that is invested in stocks and other asset classes using aggressive and relatively risky strategies to maximize profits.A hedge fund is similar to a mutual fund. It pools money from multiple investors and invests it in securities like stocks and other assets. Unlike mutual funds, though, hedge funds use more aggressive and riskier strategies. They are also very exclusive, which means they are generally only open to accredited investors.Former writer and sociologist Alfred Winslow Jones' company, A.W. Jones & Co., launched the world's first hedge fund in 1949. Jones was inspired to try his hand at managing money while writing an article about investment trends earlier that year.Jones was the first money manager to combine short selling, leverage, and shared risk by partnering with other investors. Because of his innovation and use of compensation based on performance, Jones earned his place in investing history as the father of the hedge fund.

:max_bytes(150000):strip_icc()/GettyImages-1153082516_1800-08398b5d7cbc4b82a2bebf027f46d404.png)

a sum of money or other resources whose principal or interest is set apart for a specific objective; money on deposit on which checks or drafts can be drawn —usually used in plural; capital… See the full definition

The meaning of FUND is a sum of money or other resources whose principal or interest is set apart for a specific objective. How to use fund in a sentence.a sum of money or other resources whose principal or interest is set apart for a specific objective; money on deposit on which checks or drafts can be drawn —usually used in plural; capital… See the full definitiona sum of money or other resources whose principal or interest is set apart for a specific objective… See the full definitionNoun Multiple sets of eyes should be watching everyone who has any access to the funds. —Medora Lee, USA Today, 4 Sep. 2025 Lastly, the DoD funds and manages research in fields like aerospace, cybersecurity, artificial intelligence, and medical science. —Hannah Parry, MSNBC Newsweek, 3 Sep.

California Democrat Sen. Adam Schiff launched a legal defense fund in response to the Trump administration allegedly 'weaponizing the justice process.'

Sen. Adam Schiff launches legal defense fund as DOJ investigates California Democrat for alleged mortgage fraud and Trump criticizes his role promoting the Russia hox.Schiff, however, had publicly condemned the prospect of Biden doling out preemptive pardons as "unnecessary" and setting a bad precedent.Sen. Adam Schiff launched a legal defense fund as the California Democrat faces a federal investigation for alleged mortgage fraud and President Donald Trump repeatedly condemns him for years of allegedly promoting the "Russiagate" hoax.The legal fund, dubbed "Senator Schiff Legal Defense Fund," was filed with the Internal Revenue Service Thursday, according to the New York Times.

The other big risk of using a to fund is that, if you hold it past the target date, its lack of investment risk means your nest egg will not continue to grow and you could outlive your retirement savings. According to Morningstar, investors had $3 trillion in target-date funds at the end of 2021.

A "to" fund is a type of target-date retirement fund whose asset allocation becomes most conservative at the fund's target date.A "to" fund is a type of target-date fund whose asset allocation becomes most conservative at the fund’s target date. A target-date fund is a mutual fund or an exchange-traded fund (ETF) that is structured in such a way that its assets grow in a way that is optimized for a specific timeframe.To funds can be contrasted with "through" funds, another type of target-date fund; through funds are designed to help investors through retirement, with the goal of accumulating wealth long after the retirement (target) date.To Fund vs.

The Homeowner Assistance Fund (HAF) authorized by the American Rescue Plan Act, provides $9.961 billion to support homeowners facing financial hardship associated with COVID-19. HAF funds were distributed to states, U.S. Territories, and Indian Tribes. Funds from HAF may be used for assistance ...

.tre-card__container { position: relative; display: -webkit-box; display: -ms-flexbox; display: flex; height: 100%; -webkit-box-orient: vertical; -webkit-box-direction: normal; -ms-flex-direction: column; flex-direction: column; margin-left: 0.5rem; margin-right: 0.5rem; font-size: 1.06rem; line-height: 1.5; } .tre-card__header { padding: 1.5rem 1.5rem 0.5rem; } .tre-card__body { flex: 1 1 0%; padding: 0.5rem 1.5rem; flex-basis: auto; } .tre-card__footer { padding: 0.5rem 1.5rem 1.5rem; } .tre-card-hero__header { padding-bottom: 1rem; } .tre-card.tre-card-hero .tre-card-hero__heading { font-siThe Homeowner Assistance Fund (HAF) authorized by the American Rescue Plan Act, provides $9.961 billion to support homeowners facing financial hardship associated with COVID-19. HAF funds were distributed to states, U.S. Territories, and Indian Tribes. Funds from HAF may be used for assistance with mortgage payments, homeowner’s insurance, utility payments, and other specified purposes.Through June 2024, HAF-funded programs have assisted over 549,000 homeowners, helping to prevent mortgage delinquencies and defaults, foreclosures, losses of utilities and home energy services, and displacement.Reporting: On July 15, 2025, Treasury updated the following HAF resources related to the HAF reporting requirements to align with Executive Order 14168: HAF Closeout Reporting User Guide; HAF Quarterly Report User Guide; Homeowner Assistance Fund Reporting FAQs; and HAF Guidance on Participant Compliance and Reporting Responsibilities.

Homeowner Assistance Fund by State Accede al recurso en español aquí. The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the ...

Homeowner Assistance Fund by State Accede al recurso en español aquí. The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the impacts of COVID-19.The HAF program had delivered more than $7.5 billion in assistance to nearly 575,000 struggling homeowners through September 2024. In total, state HAF programs have expended nearly 90 percent of the $9.42 billion they received through HAF. The data shows HAF continues to assist underserved communities.Eighty-eight percent of HAF recipients had incomes at or below area median income (AMI), including 51 percent who earned 50 percent or below AMI. Further, 39 percent of HAF beneficiaries identified as Black and 19 percent as Latino. (Source: U.S.The Homeowner Assistance Fund (HAF) is a $9.961 billion federal program to help households who are behind on their mortgages and other housing-related expenses (utilities, property taxes, partial claims, etc.) due to the impacts of COVID-19. The HAF program is overseen by the U.S.

A hedge fund is a private, unregistered investment fund. Hedge funds pool money from investors and invest in securities or other types of assets with the goal of getting positive returns.

Hedge funds generally pursue more flexible investments and strategies than registered investment companies, like mutual funds and ETFs, which may increase the risk of investment losses. Moreover, unlike mutual funds, ETFs, and other types of open-end funds, hedge funds are not marketed to retail investors.They are not subject to the numerous regulations that apply to mutual funds and ETFs for the protection of investors—including requiring that mutual fund shares be redeemable on a daily basis based on the net asset value (NAV); protecting against conflicts of interest; ensuring fairness in the pricing of fund shares; requiring disclosure; limiting the use of leverage; and more.Read a fund's offering memorandum and related materials. Make sure you understand the level of risk involved in the fund's investment strategies. Consider if the risks are suitable to your personal investing goals, time horizons, and risk tolerance.A hedge fund is a private, unregistered investment fund. Hedge funds pool money from investors and invest in securities or other types of assets with the goal of getting positive returns.

The Homeowner Assistance Fund (HAF) is a federal program that was intended to help homeowners who were financially impacted by COVID-19. Each state has a program and might still have funds available. The money for the program is limited.

The Homeowner Assistance Fund (HAF) is a federal program that was intended to help homeowners who were financially impacted by COVID-19. Each state has a program and might still have funds available. The money for the program is limited.Application submission does not guarantee you will receive financial assistance. Depending on your area, some programs may not have enough money to help every applicant. Some locations expect to receive more applications than can be funded by their program.If you have been denied for HAF, you can try to get in contact with a representative from your local HAF program who can explain why you did not meet their eligibility criteria or if funds are no longer available for the program.If you do not meet the eligibility requirements for HAF or your state no longer has funds available and are still concerned about losing your home, there may be other options available to you. You can contact a HUD-approved housing counseling agency. They can help you figure out your options and guide you through the paperwork and process of working with your servicer.

In June 2011, the hedge fund management firms with the greatest AUM were Bridgewater Associates (US$58.9 billion), Man Group (US$39.2 billion), Paulson & Co. (US$35.1 billion), Brevan Howard (US$31 billion), and Och-Ziff (US$29.4 billion). Bridgewater Associates had $70 billion in assets under ...

In June 2011, the hedge fund management firms with the greatest AUM were Bridgewater Associates (US$58.9 billion), Man Group (US$39.2 billion), Paulson & Co. (US$35.1 billion), Brevan Howard (US$31 billion), and Och-Ziff (US$29.4 billion). Bridgewater Associates had $70 billion in assets under management as of March 2012.By example the manager sets a hurdle rate equal to 5%, and the fund return 15%, incentive fees would only apply to the 10% above the hurdle rate. A hurdle is intended to ensure that a manager is only rewarded if the fund generates returns in excess of the returns that the investor would have received if they had invested their money elsewhere.In 2011, half of the existing hedge funds were registered offshore and half onshore. The Cayman Islands was the leading location for offshore funds, accounting for 34% of the total number of global hedge funds. The US had 24%, Luxembourg 10%, Ireland 7%, the British Virgin Islands 6%, and Bermuda had 3%.Deutsche Bank and Barclays created special options accounts for hedge fund clients in the banks' names and claimed to own the assets, when in fact the hedge fund clients had full control of the assets and reaped the profits.The hedge funds would then execute trades – many of them a few seconds in duration – but wait until just after a year had passed to exercise the options, allowing them to report the profits at a lower long-term capital gains tax rate.

TexasHomeownerAssistance.com had 3.96 million visits from 1.38 million users, including views of content in Spanish, Korean, Vietnamese and Chinese.

On March 11, 2021, the President of the United States signed the American Rescue Plan Act, which included the Homeowner Assistance Fund (HAF), into law. The State of Texas received $842,214,006 in HAF funds and Texas Department of Housing and Community Affairs (TDHCA) was designated as the entity to administer the HAF for the state.TXHAF funded up to $65,000 per household to assist households with payments for mortgages, property charges, including property taxes, property tax loans, mortgage insurance premiums, hazard insurance premiums, flood or wind insurance premiums, ground rents, condominium fees, cooperative maintenance fees, planned unit development fees, homeowners’ association fees, and/or utilities.

There are times when a lender might have lots of funds but lack customers. At other times, they may get a customer but may not have enough in reserve to service the loan application. Turning down the customer would of course result in opportunity loss.

Lenders lead busy lives, always juggling funds trying to maintain a balance between having enough to service new customers but at the same time making sure a good portion of their capital is leveraged and not lying idle.Let’s say our lender gets a new customer but does not have enough funds to provide the loan.Rather than turning down the application, he creates an auction on the HaveFund platform to sell the opportunity to other lenders who have more available funds.

The platform HaveFund was created with the idea of bringing a new approach of getting, or giving loans by implementing the disruptive technology of blockchain into its core mechanism. Allowing…

The platform HaveFund was created with the idea of bringing a new approach of getting, or giving loans by implementing the disruptive…By offering a solution where needs and demands can be customized depending on a specific strategy, the actors of this market will no longer suffer from traditional practices that have limited their scope of action. HaveFund expands the horizons for new funding and investing possibilities.Anyone of us will, or has encountered the same difficulties when it comes to getting funds.Facing nowadays’ challenge for institutions to find the right balance between funds and customers, HaveFund offers a disruptive platform that allows them to find the best candidates for their investment.

Torrid growth of hedge funds and their huge impact on securities markets prompt some observers to fear a bubble or at least the consequences of such growth, built as it is on leverage that banks provide managers to double or triple their investment bets; adding to concerns are mystery surrounding ...

Torrid growth of hedge funds and their huge impact on securities markets prompt some observers to fear a bubble or at least the consequences of such growth, built as it is on leverage that banks provide managers to double or triple their investment bets; adding to concerns are mystery surrounding what kind of financial products are being traded by funds and how they value them, as well as proliferation of funds of funds, pools of hedge funds that are meant to lower risk but that also come with another layer of fees on top of what standard hedge funds charge; even some hedge fund experts who play down notion of investment bubble acknowledge possibility of compensation bubble, since fund managers do not receive fixed percentage of funds they manage, but rather 1 percent of assets under management and 20 percent of profits; photos; graphs (L)Richer than Wall Street rich and more willing to take risks than their traditional money management peers, they are the managers behind the staggering growth in hedge funds, those private, lightly regulated investment vehicles aimed at the ultrawealthy, the run-of-the-mill wealthy and, increasingly, the not-so wealthy.Spectacular accumulation of wealth in a short time. New ventures created easily and often. Those, too, were the hallmarks of the dot-com boom, and, as everyone knows, the bursting of that bubble was far from pleasant. The stampede to hedge funds, some people fear, will be no different.The numbers are mind-boggling: 15 years ago, hedge funds managed less than $40 billion. Today, the figure is approaching $1 trillion. By contrast, assets in mutual funds grew at an impressive but much slower rate, to $8.1 trillion from $1 trillion, during the same period.

A hedge fund is an actively managed private investment fund whose money is pooled and managed by professional fund managers. These managers use a wide range of strategies, including leverage and the trading of nontraditional assets, to earn above-average investment returns.

A hedge fund is an actively managed private investment fund whose money is pooled and managed by professional fund managers. These managers use a wide range of strategies, including leverage and the trading of nontraditional assets, to earn above-average investment returns.Hedge funds pool money that's managed to outperform average market returns. The fund manager often hedges the fund’s positions to protect them from market risk. This is done by investing some of the assets in securities whose prices move in the opposite direction of the fund’s core holdings.Hedge Funds vs.A hedge fund is an actively managed investment that pools money from accredited investors and seeks high returns by using complex strategies and significant risk.

:max_bytes(150000):strip_icc()/hedge-fund-e24f63dddbea46509acc50e93e12132f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1153082516_1800-08398b5d7cbc4b82a2bebf027f46d404.png)

:max_bytes(150000):strip_icc()/hedge-fund-e24f63dddbea46509acc50e93e12132f.jpg)